Given the horrific news we have all seen and heard about the situation in Ukraine over the past couple of weeks, we felt it was important to write to all our clients to offer an overview on the market reaction, as well as the potential head winds we may face.

Despite all the uncertainty over Covid and the threat of interest rate rises, markets performed well in 2021 but with Russia’s invasion of Ukraine adding to the concerns of investors, the first few months of 2022 have been a totally different story.

The UK market initially held up reasonably well thanks to its heavy concentration of companies that have been unpopular for a decade, but which have returned to favour as investors look for undervalued investments.

The FTSE 100 is particularly biased towards the oil majors and mining companies which have benefited from inflated commodity prices with the global demand for oil and gas soaring even before the invasion occurred.

By contrast, other major markets had a more difficult start to the year with US declining by more than 7% in the first two months and European markets by almost 9%.

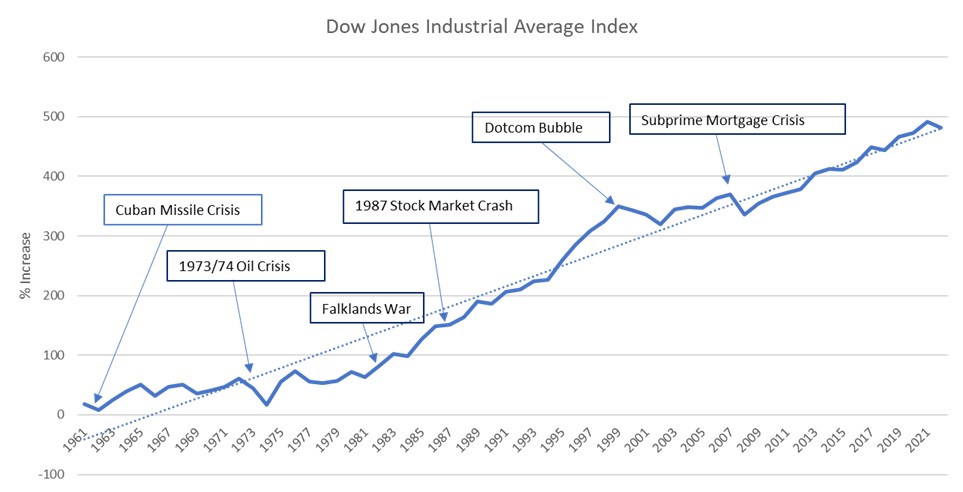

Despite the current uncertainty, it should be remembered that markets have endured a considerable number of shocks over the years that have given rise to sharp falls in share prices from which they recovered and subsequently thrived. These include the oil crisis in 1973/1974, when the UK market fell by around 80%; the Falklands War in 1982, the stock market crash of 1987, the dotcom bubble of 1999/2000, the subprime mortgage crisis of 2007/2008, and the Covid-19 pandemic; not to mention two Gulf Wars, 9/11, and various other conflicts around the world.

Purely from a business point of view, it is always important to have perspective on the current situation as seeing and listening to the news can give us all a sense of nervousness. This has led us to compile the chart below, which covers the period from a year prior to the Cuban Missile Crisis in 1962 to date; this highlights the ability of markets to recover from such shocks.

With Russia clearly determined to achieve its objectives at all costs and fighting in Ukraine intensifying, all of the world’s stock markets were thrown into turmoil, the first few days of March seeing a particularly sharp fall in share prices.

The sanctions imposed on Russia as well as the resulting spike in commodity and energy prices are likely to have significant inflationary shock on the global economy that is likely to persist for longer than previously anticipated.

Markets, particularly in Europe, saw one of their biggest one day rises on 9th March this year on the back of an agreement by OPEC to increase oil production to plug the gap from sanctioned Russian oil.

The jump in European markets on 9th March was also due to speculation that the ECB (European Central Bank) may provide economic stimulus similar to that seen during the COVID-19 pandemic in order to calm markets and boost business resilience. This offers investors some comfort in troubling times, however, the rise whilst welcomed, may erode if the war escalates further.

The sanctions being introduced, including the SWIFT transaction restrictions, will put huge pressure on Russia’s banking system and make it very difficult for the Central Bank to intervene in foreign exchange markets or provide a level of stability. We have seen the Rouble plummet and long queues forming outside banks and ATMs to draw cash; therefore, the impact of the sanctions is having a noticeable effect on the Russian population.

Whilst it is impossible to predict how the war in Ukraine will pan out, it is clear that markets are likely to remain more volatile than expected for some time given the likelihood of a prolonged period of geopolitical tension.

Against this background and despite the inflationary implications of recent events, corporate earnings are expected to continue their recovery in 2022, but it remains to be seen how this will impact share prices.

We hope this has provided a balanced view, without trying to be over optimistic nor too pessimistic, to a complicated situation which we have not had to face for some considerable time. That said, as illustrated previously, markets do recover from these shocks and as always if you have any concerns or queries then please do contact us and we will be happy to discuss further.