Despite uncertainty over the likely course of the Covid pandemic and in the latter part of the year, the threat of interest rate rises in response to rising levels of inflation as a result of supply chain disruption, markets performed well in 2021 but following Russia’s invasion of Ukraine, the first few months of 2022 have been a totally different story.

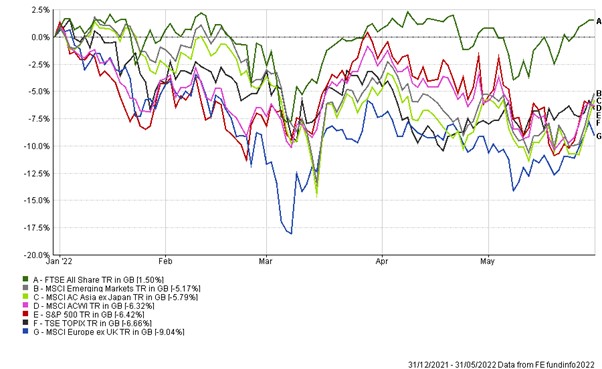

As the chart below shows, with the exception of the UK, which has held up reasonably well thanks to its heavy concentration of companies that have been unpopular for a decade but have returned to favour as investors look for undervalued investments, most of the world’s markets were lower at the end of May than at the start of the year. The hardest hit are those in Europe that are most affected by the sanctions imposed on Russia such as France and Germany, which had fallen by 9.6% and 9.4%, respectively.

As well as the resulting spike in commodity and energy prices, these sanctions are expected to have significant inflationary shock on the global economy that is expected to persist for longer than previously anticipated. At the same time, the SWIFT restrictions are putting huge pressure on Russia’s banking system and make it very difficult for the Central Bank to intervene in the foreign exchange markets or provide a level of stability, hence the decree that foreign buyers of Russian gas need pay for in roubles.

While it is impossible to predict how the war in Ukraine will pan out, it is becoming increasingly clear that the fighting will continue for some time to come. As a result, we may well see a further periods of volatility in markets given the likelihood of a prolonged period of geopolitical tension.

In the meantime, some observers are concerned that in their attempt to keep inflation under control using interest rates rises, central banks might push the world’s economies into recession as they did in attempting to control spiralling inflation in the 1970s. However, this seems unlikely given that central banks now pay much more attention than in the past to ensuring that interest rate rises do not dampen economic growth to any great extent.

Despite the inflationary implications of recent events, corporate earnings are expected to continue their recovery in 2022, albeit at a slower pace than originally expected. However, it remains to be seen how this will impact on share prices given the uncertain outlook.