With so many headwinds facing markets, 2023 was always going to be a challenging year for investors. However, with only six months of the year having elapsed, we’ve had more than our fair share of bad news.

While the failures of the Silicon Valley Bank and Signature Bank in the US came as a shock, the need for Credit Suisse to be rescued by UBS did not come as any great surprise given the long list of problems faced by the former in the last few years.

Share prices fell sharply as a result of these events, but central banks acted swiftly in an attempt to avoid contagion with the result that markets regained their poise following the initial shock.

The subsequent demise of First Republic confirmed fears that further problems might lie ahead for the banking sector and the war in Ukraine continues to cast shadow over markets with Russia seemingly unwilling to concede that it is unlikely to achieve its objectives. China’s intentions towards Taiwan also remain a concern, particularly following the military response to U.S. House Speaker, Kevin McCarthy’s meeting on 5th April with Taiwanese President, Tsai Ing-wen.

More recently, concern over the possibility that a compromise over the raising of the debt ceiling might not be forthcoming with the result that the US would default on its national debts, unsettled markets once again.

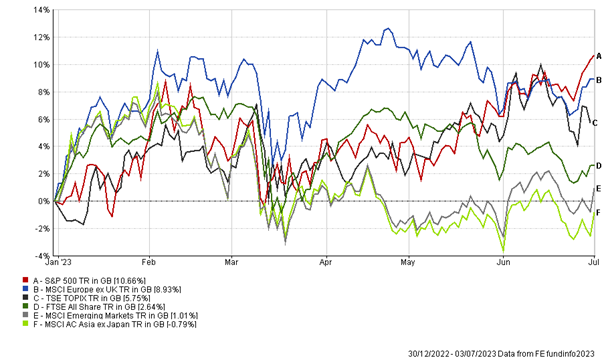

Despite all the uncertainty and volatility, most of the major markets have made at least some progress in the first six months of 2023 as the chart below shows.

Looking ahead, while it is impossible to predict how the war in Ukraine will pan out, it is becoming increasingly clear that the fighting will continue for some time to come. The attempted coup in Russia has not helped as it could lead to an escalation of the war as Vladimir Putin tries to convince his critics that he is still very much in control. As a result, and with all the other uncertainties, markets are likely to remain volatile through the rest of 2023.

On a more positive note, markets reacted well to the falls in the rate of inflation announced since the start of 2023 and should continue to do so as long as the central banks take the appropriate action. However, market professionals are becoming concerned that they may continue to tighten for longer than expected and increase the threat of recession.

In the UK, inflation is proving more ‘sticky’ than elsewhere thanks largely to the rising cost of food. The rate remained stubbornly high at 8.7% in April and May, when 8.4% had been widely predicted in both months, giving rise to fears that the Bank of England might decide to raise interest rates still further and tip the UK into recession.

While some of the world’s economies are expected to do so during 2023, the Bank of England had been suggesting that a recession in the UK may well be avoided, contrary to the view expressed by the IMF. However, the IMF recently changed its mind and agreed that a recession in the UK was not a foregone conclusion, something that it might be regretting given the possibility of more interest rate rises. Only time will tell!

In the meantime, corporate earnings are expected to continue their recovery and while growth is likely to be at a much slower pace than originally expected, it seems likely that with the rate of inflation continuing to fall, 2023 will be a better year for markets than 2022.