As we move into the final month of the year, it is time to draw breath on what has been one of the most fraught times for investors. Thankfully, the outlook for 2023 is looking a little more settled (all caveats apply here) you will be pleased to hear!

It might be stating the obvious, but 2022 has been a difficult year for world markets. It began with interest rates starting to rise in response to rising levels of inflation thanks to supply chain disruption. Despite hopes that higher levels of inflation would be transitory, they have proved to be more ‘sticky’ than originally expected with the result that there has been concern that central banks might be too aggressive with interest rate rises and push the world’s economies into recession.

At the same time, Russia’s invasion of Ukraine, sent shock waves through markets in the first quarter. With Vladimir Putin threatening to use nuclear weapons as the war drags on and Russian troops are forced to retreat, investors remain concerned about the economic consequences.

China’s intentions towards Taiwan have also come into question and this has added to the uncertainty. More recently, China’s strategy of controlling Covid-19 with lockdowns, mass testing and quarantines has provoked the greatest show of public dissent against the ruling Communist party in decades. The zero-Covid strategy has impacted on China’s economic growth and has also led to further disruption of the supply chain, which has contributed to a slowing of economic growth around the world.

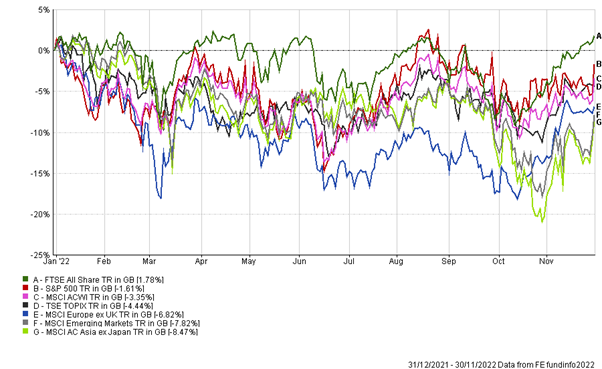

The net result is that markets have been extremely volatile as the chart below shows.

As can be seen, with the exception of the UK, all of the world’s major markets were lower at the end of November than at the start of the year. Among the most severely impacted have been those in Europe that are the most affected by the sanctions imposed on Russia. Asian and Emerging markets have also suffered as a result of the strength of the US Dollar which has appreciated by 13% this year having been more than 26% higher in late September.

In addition to the resulting spike in energy prices, the sanctions have had a significant inflationary shock on the global economy. While energy prices have since eased, they are still well above the levels seen both before the start of the Covid-19 pandemic and Russia’s invasion of Ukraine.

While it is impossible to predict how the war in Ukraine will pan out, it is becoming increasingly clear that the fighting will continue for some time to come. As a result, markets may well continue to experience a certain amount of volatility going forward, given the likelihood of a prolonged period of geopolitical tension. However, it is unlikely to be at the same level as seen since the start of 2022.

In the UK, the market was rocked by the budget which was announced following the election of Liz Truss as the leader of the Conservative Party and Prime Minister. However, the action taken by Jeremy Hunt following his appointment as Chancellor of the Exchequer, the resignation of Liz Truss and the election of Rishi Sunak as the new leader of the Conservative Party and Prime Minister has helped to restore stability. The Chancellor’s Autumn Statement has provided further reassurance that the UK economy in now in safe hands.

Markets have also reacted positively to the recent fall in the rate of inflation in the US, which is expected to result in interest rates peaking at a lower level than originally expected. The subsequent announcement of a fall in the rate if inflation in the Eurozone is also very encouraging. While there has been little evidence to suggest that the UK is about to follow suit, we will have a better idea by the 14th December when the Office for National Statistics are due to report figures for the end of November. However, there is growing optimism among market professionals that UK interest rates will also peak below the levels first anticipated, albeit at a later date than the US.

Despite all the uncertainty, corporate earnings are expected to continue their recovery in 2023, if not in the UK, then most certainly in the US and elsewhere. While growth is likely to be at a much slower pace than originally expected, we are hopeful that with the rate of inflation starting to fall, 2023 will be a better year for markets than 2022.

Given all that has occurred over the past year at least we can end on a positive note for a change.

All that is left to say now is, we at P J Aiken hope you have a great Christmas and let’s hope for a more peaceful and settled 2023!