It is hard to believe all that has happened so far this year; a war, an energy crisis, high inflation, huge rises in interest rates and the Bank of England stepping in to effectively stop the pound from a total collapse.

In this Autumn newsletter we attempt to explain and provide some understanding of some of these events, particularly those over the past few weeks with both a market insight and outlook. This newsletter has had to be re-written several times due to the significant changes which have occurred over the past few weeks.

Firstly, our message and advice in these uncertain times is…Don’t panic! Staying calm is a challenge given our world of 24/7 news which has not been the most positive for a while, time in the market and not timing the market is always key. It is never comfortable going through these volatile times and we have had our fair share of events providing significant volatility to global markets, particularly in the last few years.

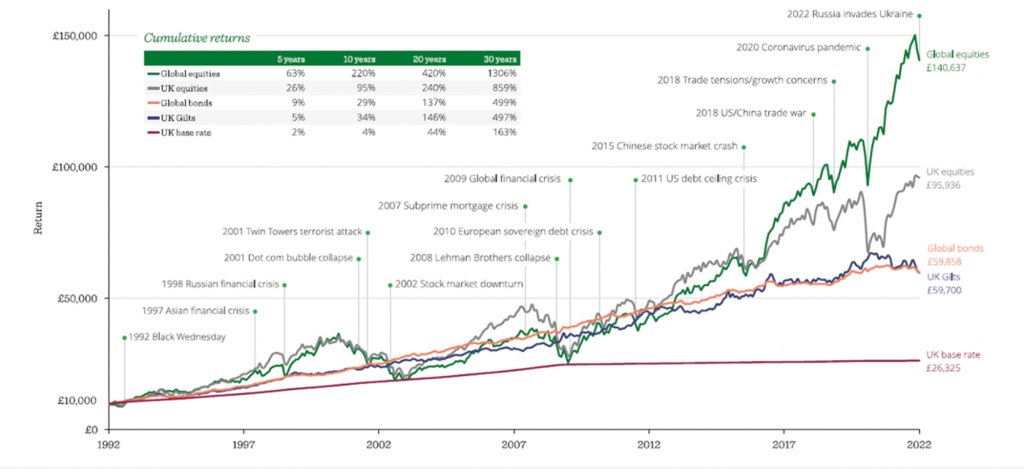

To illustrate the point the chart below outlines performance in 5 key investment areas, as you can see equities always recover as history has shown us, time after time:

Source Quilter Investors – Return in pounds sterling 28th February 1992 to February 2022

The most recent event which created volatility was just a few weeks ago when the Bank of England had to essentially bail out the Government for their ill thought-out mini budget, with a significant commitment to purchase long dated Government Bonds (gilts), essentially printing money, to the tune of £65bn. This being a complete turnaround on their announcement previously when they had confirmed they will sellgilts in order to unwind all the Quantitative Easing which dates back to the financial crises of 2008/9 and 2020, at the time of the Covid outbreak.

Why is this significant? Firstly, the Bank of England has ONLY intervened when there has been a global crisis affecting financial markets’ stability to function properly. This intervention was seen as a necessary step in reaction to the Government’s mini budget, one which has faced criticism from all angles including, rather embarrassingly, the IMF which usually only comments on the activities of some emerging markets, not a member of the G7.

The Bank of England, faced with a collapse in the price of gilts and the pound, had no option but to intervene as it was forcing pension funds (final salary schemes, annuities, corporate schemes) and big banks on international markets to sell gilts which was forcing the price lower. If they had not intervened, pension funds may not have been able to pay their debts which would have had significant repercussions for pension members.

The fallout from all of this is the impact on interest rates, with a record number of mortgage deals being withdrawn as lenders try to establish how high rates are going to go in the coming months. The pound and the gilt market have rallied, due to expectations that the tax cuts will have to be ditched or severely delayed.

There has been some reason to cheer with renewed optimism in equity markets, the upbeat mood was largely due to “growing speculation that central banks could soon pivot towards a more dovish stance”, wrote analysts at Deutsche Bank, which showed US manufacturing activity was lower than anticipated in September, suggesting a cooling in the US economy. This could be a sign that central bankers may be easing off aggressive interest rate moves.

However, we live in strange times, where good news is not always seen as good. Last week the US released data on continued high employment rates, this would normally be seen as very good news, showing that an economy is doing well, however markets reacted badly to this with a sharp sell off. The sell off was due to the fact that the data will only force the Federal Reserve to keep raising interest rates, until they see continued signs of a slowdown in the economy and, more importantly, inflation.

It all is very unnerving and again we are faced with an unprecedented set of scenarios, so where is the good news; something that can provide us with a positive outlook?

Whilst 2023, has a mixed outlook, it does offer some hope. Earnings from companies, whilst expected to be less than this year should be helped by the easing of supply chain issues which have dogged 2021/22. Energy prices are expected to fall from their elevated levels; both of these will help reduce inflation from the record highs we have seen, although it will remain well above central bank’s target of 2%.

However, a lot does depend on how the situation in Ukraine plays out over the coming months, along with the effects on economies from higher global interest rates.

In summary the news headlines can be very dramatic and make us all nervous about the present and future, however often the actual data behind the headlines is very much more mundane. We, as always continue to monitor your portfolios taking the long term view, and it is important to remember that as we saw in 2020 markets can fall sharply, however once a recovery starts, it’s pace can catch the market by surprise.

As always if you have any questions or queries regarding your portfolio or investment matters then please contact us and we will be happy to advise.